If combining your Passion with Philanthropy and Profit sounds too good to be true we would like to introduce you to Impact Investing.

Purposely using your beliefs and your resources—in this instance, a portion of your investments—to give someone else a chance may give your money and even your life new meaning.

What are these magical beans we speak of Jack?

In the good old days, if you were a PHILANTHROPIST passionate about fighting malaria you might have donated $10,000 to a charity dedicated to buying malaria nets for vulnerable people in Africa. Maybe, as a nice gesture of gratitude, they would then have added your name to some of their leaflets and their website.

In the good old days, if you were a PHILANTHROPIST passionate about fighting malaria you might have donated $10,000 to a charity dedicated to buying malaria nets for vulnerable people in Africa. Maybe, as a nice gesture of gratitude, they would then have added your name to some of their leaflets and their website.

But, over time companies and foundations became more invested in approaches such as pollution prevention, corporate social responsibility and triple bottom-line accounting (where social and environmental outcomes are also calculated). Together with this new thinking, a new type of investor emerged:

The SOCIALLY RESPONSIBLE INVESTOR (SRI). Who also invested $10,000. This time, in a company that manufactured malaria nets and had been screened for its ethical, environmental sustainability and good corporate and community practices.

Then, in 2007 or thereabouts, a commitment to measuring ethical community and conservation performance with the same rigour as financial performance became the standard and the IMPACT INVESTOR was born.

An IMPACT INVESTOR will invest $10,000 in a for-profit company developing malaria vaccines. The worst-case scenario is that this will also turn into a donation if that malaria vaccine company goes bust. But, if the business grows and becomes more profitable the Impact Investor may make some money.

Then, of course, there is a best-case scenario. The malaria vaccine company is acquired, and the Impact Investor’s return becomes truly excellent.

Allowing the Impact Investor to invest in more business, creating even more social good.

The allocation grows faster than the need that it serves, and the cycle becomes self-sustaining.

AN IMPACT INVESTOR INTENDS TO INITIATE MEASURABLE, BENEFICIAL, SOCIAL OR ENVIRONMENTAL IMPACT AS WELL AS FINANCIAL GAINS THROUGH AN INVESTMENT INTO COMPANIES OR ORGANISATIONS IN EMERGING OR DEVELOPING MARKETS.

Inside the Machine

Already a complex network of career opportunities has sprung up to support every phase of the game.

Already a complex network of career opportunities has sprung up to support every phase of the game.

Risk management is specifically unpredictable with Impact Investments. There are people working in sourcing leads as analysts or associates conducting primary and secondary research to identify potential investees for an organisation. Some team members analyse financial statements and models and conduct field visits, diving into organisations and performing due diligence. This is important because it is not unheard of for some young social enterprise to struggle to attract talent early in its development or if all its operation is happening in a remote area.

Then there is the investment team who negotiates with the entrepreneur and the investors who add value to the entrepreneurs through capacity building. Impact markets are less proven by nature and added value might range from help in developing baseline metrics through to identifying and recruiting board members. And then we come full circle back to more analysts who track and measure an organisation’s social and environmental footprint.

The folk working in Impact Investment may come from a varied background. Degrees in environmental science, nonprofit experience, and traditional banking or corporate finance backgrounds can all be a ticket providing entry to a career in this field.

Basic Rules of Investment Still Apply

Impact investing is a broad term encompassing many investing mechanisms and a broad range of technical terms. But whilst the field of impact investing is relatively new it is developing very quickly. And this relatively early growth stage allows for tremendous opportunities in the field.

Impact investing is a broad term encompassing many investing mechanisms and a broad range of technical terms. But whilst the field of impact investing is relatively new it is developing very quickly. And this relatively early growth stage allows for tremendous opportunities in the field.

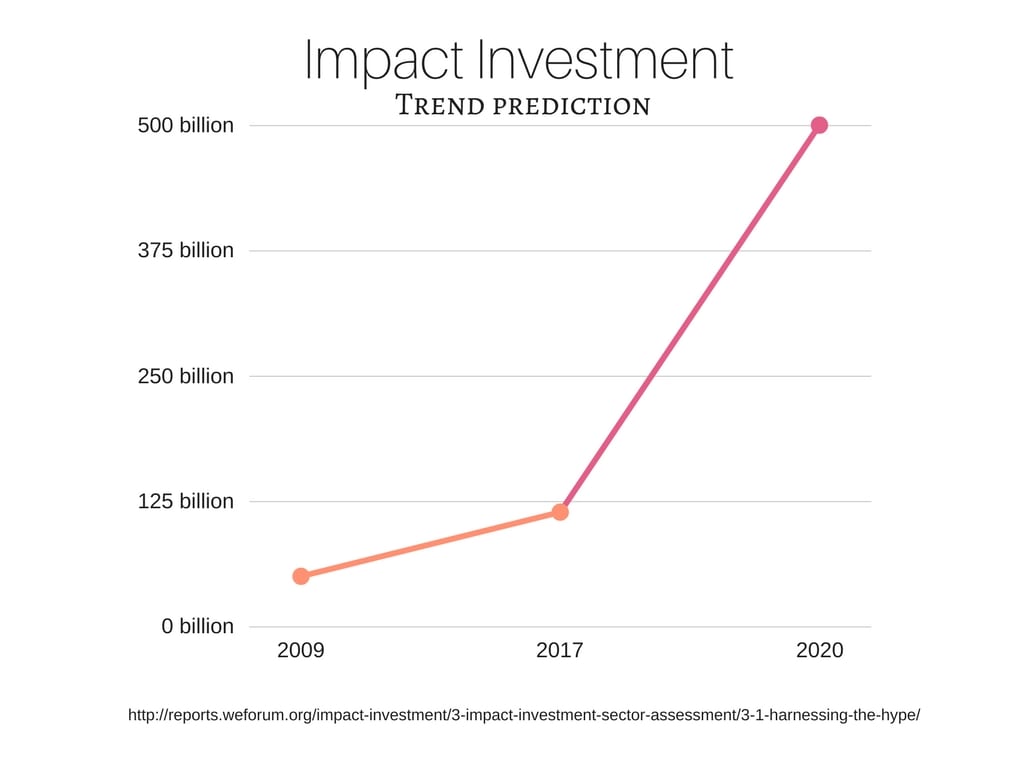

The global equity market was estimated at US$ 61 trillion by the World Bank in 2015 and Impact Investors managed to invest US$ 114 billion according to GIIN’s 2017 Annual Impact Investor Survey (compared to an estimated US$ 390 billion donated to doing good from US non-profit organizations). This figure may grow to around $500 billion in assets by 2020.

Why is it growing so quickly? Two reasons that could be put forward are:

Why is it growing so quickly? Two reasons that could be put forward are:

* The criticism of traditional philanthropy and international development which have been characterized as unsustainable.

* The goals of donors that are driving it.

Leaders in the Impact Investing development is North American, the European development finance institutions, pension funds, endowment and (under Pope Francis) the Catholic Church. The British Commonwealth Development Corporation or Norwegian Norfund also allocate a portion of their portfolio to investments that deliver both financial as well as environmental and social benefits.

Other standard rules apply, such as:

💰 Returns can target a range from below-market to above-market rates depending on the investor’s goals.

💰 Impact investing occurs across asset classes; for example, private equity/venture capital, debt, and fixed income.

💰 Such capital may be deployed using a range of investment instruments, including equity, debt, real assets, loan guarantees, and others.

💰 Impact Reporting and Investment Standards metrics that have been established across the industry.

Mechanisms of Impact Investment

Impact investment usually happens through the following means:

💰 Private equity or venture capital

💰 Social venture capital

💰 Impact investment accelerators

💰 Pension Funds

💰 Mission investments by foundations: PRIs, MRIs

But Individuals can also become involved in Impact investment:

💰 Exchange-traded funds are available to anyone with a stock brokerage account.

💰 Syndicate or pooled investing through groups of angel investors focused on impact.

💰 Digital microfinance platforms offering lower-cost investing services.

Criteria for Impact Investing

💰 Debt or equity investments over US$1,000 (excluding the usual crowdfund).

💰 Longer-than-traditional venture capital payment times.

💰 An exit strategy may be nonexistent. (no initial public offering or buyout for instance).

💰 Typically involves for-profit, social- or environmental-mission-driven businesses. (But legally the organization may be a for-profit, not-for-profit, B Corporation, Low-profit Limited Liability Company, Community Interest Company, or other designations that may vary by country. In Europe, they are known as social enterprises.

Some Enterprise Examples

💰 For-profit technology businesses improving education, health, economic empowerment, poverty alleviation, resource efficiency, renewable energy, and basic services including housing, healthcare, education, microfinance, and sustainable agriculture.

💰 A specific for-profit business e.g. A social venture fund helping teachers track and report academic or behavioural progress for students with disabilities.

Tips for Becoming an Impact Investor

-

Consider the problems you are passionate about solving.

-

Consciously decide to limit your exposure by investing only a portion of your portfolio already allocated for private equity.

-

Be clear about the impact that you expect the company to make, whether this is number of people it affects or feedback on customer satisfaction. Intentions are not good enough – insist on sustainability.

-

Don’t invest in companies. Invest in people.

-

Co-invest with others and share resources and learn.

-

Take a professional approach.

-

Perform due diligence

-

Use a disciplined strategy to make a series of investments.